Are you looking to transfer money to Philippines but unsure which service to use? Nowadays, sending money abroad has become much easier and faster. Whether it’s for business, education, or sending money to family in Philippines, it can all be done conveniently.

Before starting your transfer, ensure you have the SWIFT code of the Philippines bank. The SWIFT code functions like the “address” of the recipient bank, ensuring your money reaches the correct account. Curious about how to transfer money to Philippines using Transfez? Read the full guide in this article.

Read also: Cost of Living in Philippines 2024

Understanding SWIFT Codes for Money Transfers to Philippines

When conducting an international transfer to the Philippines, one essential detail is the SWIFT code or BIC (Bank Identifier Code). This unique SWIFT code acts as the “address” of the recipient’s bank, ensuring your transaction reaches the correct account securely.

A SWIFT code consists of 8-11 characters, combining letters and numbers. Each part of the code has a specific meaning. The first four characters represent the bank code, followed by two characters for the country code (PH for the Philippines). The next two characters indicate the city’s location code, and the optional final three characters specify the branch code.

There are several ways to check the SWIFT code for your recipient’s bank in the Philippines. You can visit the official website of the recipient’s bank, search through online engines (Google, Bing, Yahoo, etc.), or use the Online SWIFT/BIC Code Checker on the Transfez website. Simply select the country and bank name to retrieve the SWIFT code you need.

Using the correct SWIFT code is crucial for international transfers. A mistake in entering the code may result in a failed transaction. If in doubt, don’t hesitate to confirm the details with the recipient bank.

3 Money Transfer Services to Philippines

Here are some services you can use to send money to the Philippines:

1. Western Union

Western Union is one of the most trusted international money transfer services, with a vast network across Indonesia. You can visit the nearest agent and provide transfer details such as the amount, target currency, and recipient information. Then, proceed with the payment.

Once the transaction is complete, you will receive an MTCN (Money Transfer Control Number) that the recipient can use to collect the money at the nearest Western Union agent. With Western Union’s “Money in Minutes” service, recipients can access the money within minutes after the transfer is completed.

2. Remitly

Remitly is a digital money transfer service that supports transactions to the Philippines through partnerships with various banks in the country. You can send money abroad via Remitly’s official website or mobile app.

Unfortunately, for users in Indonesia, Remitly does not support transfers in IDR. However, you can still use other currencies like USD or SGD for transfers to the Philippines.

3. Banks

You can also transfer money through banks using internet banking or by visiting the nearest branch with a valid ID. Ensure you have the recipient’s full details and the SWIFT code for their bank.

International transfers through banks typically take about 1-7 business days and may involve higher administrative fees compared to other methods.

Check Other Money Transfer Destinations with Transfez

Send Money to Malaysia

Send Money to Singapore

Send Money to the Philippines

Send Money to India

Send Money to Vietnam

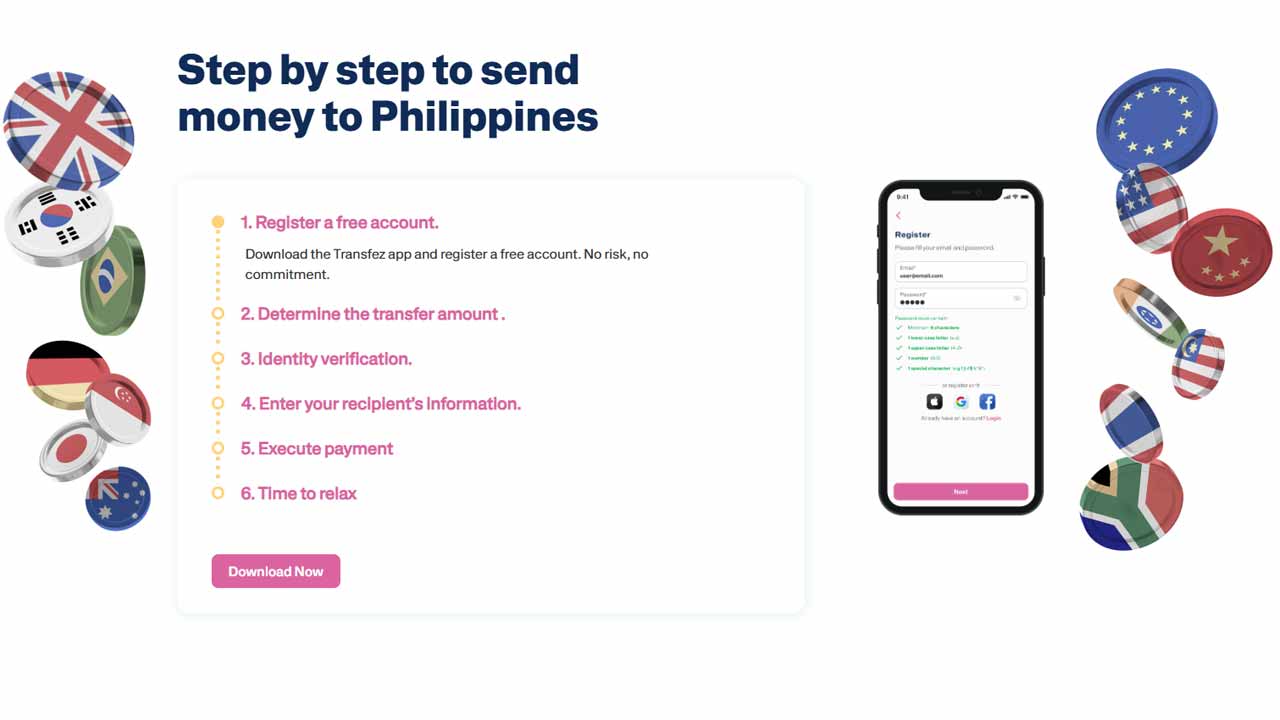

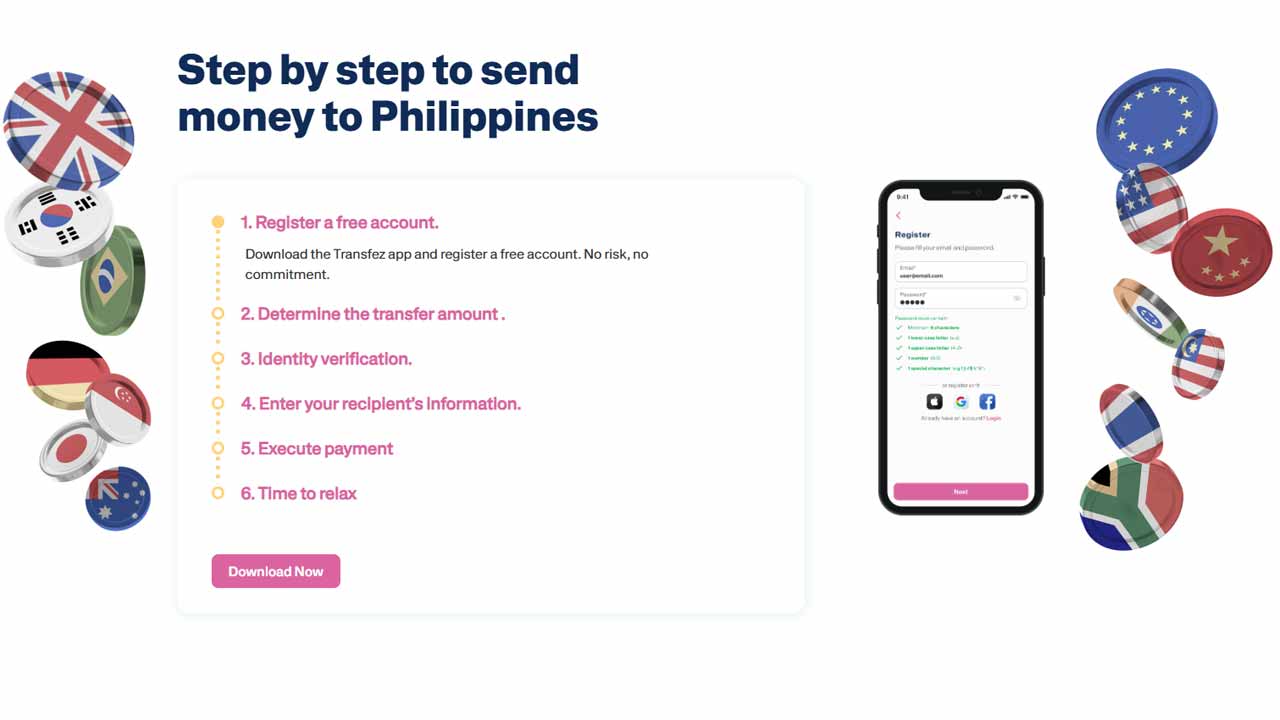

Easy Money Transfers to Philippines with Transfez

What makes transferring money abroad with Transfez special? One of the key advantages is that you can transfer money to over 70 countries in 33 currencies with competitive exchange rates and affordable fees. Most importantly, your transactions are secure because Transfez is officially registered and monitored by Bank Indonesia.

1. Download and sign up on the Transfez app for FREE;

2. Enter the amount to be sent;

3. Verify your identity;

4. Provide the recipient’s information in the Philippines;

5. Complete the payment;

6. Your money transfer is done!

Download Transfez App

Transfez App can help you transfer money abroad more quickly and efficiently. Transfez Business can also help your business in making transactions abroad. For those of you who want to send money to relatives who are abroad because they are studying, working, or traveling, Transfez will be ready to help. This app is available on Android as well as iOS.

Safe, fast, and cost-effective! With Transfez, sending money to the Philippines is easier than ever. For just IDR 69,000 per transaction, you can send any amount without additional fees. Enjoy quick service with an estimated delivery time of only +2 hours on business days. Funds can be sent directly to the recipient’s bank account or e-wallet in the Philippines. Download the Transfez app now and experience seamless money transfers to the Philippines!