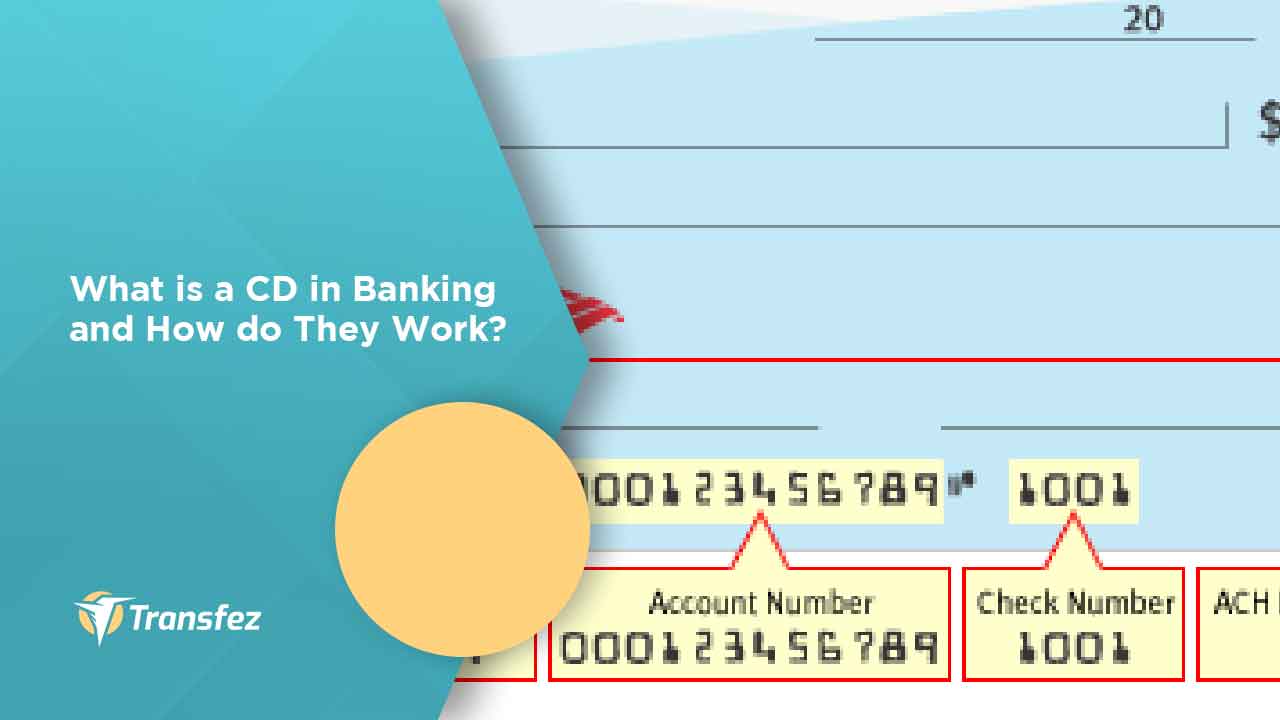

It will be interesting to know about what is a CD in Banking. CD or Certificate Deposit at the bank certainly has different characteristics from all other bank products. Not everyone knows about this product. But of course, this service is no longer a foreign thing for some bank customers.

Certificate Deposit or also often referred to by CD has a special definition that is deposited in the form of deposits whose proof of deposit certificates can be transferred. You could say that its presence is very important, especially for investors. To get to know more closely about this type of service from a bank institution, then you can see the following explanation.

Understanding About What is a CD or Certificate Deposit

Certificate Deposit becomes one form of service of a bank financial institution. This service product is an investment product issued by a bank institution. This product comes as a form of premium interest rate as well as evidence for customers who have kept their deposit within a certain period. Of course, the presence of this certificate can also be referred to as a document on the point that does not include the name of the owner.

These certificates of deposit are issued by almost all financial institutions or bank institutions. But the terms and conditions imposed by each bank may be different from each other.

See Also Articles About How to Open Bank Accounts in Different Countries

How to Open a Bank Account in Australia

How to Open a Bank Account in Hong Kong

How to Open a Bank Account in China

How to Open a Bank Account in India

Anyone who invests in this form in the bank will certainly get its benefits. Because this form of investment is certainly safe and tends to be more conservative when compared to other investments such as stocks and bonds. As a product from a bank that is considered profitable, it tends to offer lower growth opportunities with generally non-volatile returns.

Characteristics of Certificate Deposit

Deposits issued by financial institutions certainly have some characteristics that can distinguish them from other bank products. One of the common characteristics that this type of deposit has is having a certain period.

The period on this certificate will indicate that you are only allowed to withdraw funds precisely if the time has come following the date that has been determined and commonly referred to by the term maturity. If not, then you will be subject to a penalty that is usually fine.

See Video How To Easily Send Money Abroad

The second characteristic of this certificate t is the existence of higher interest rates that will be paid in advance. This prepayment will clarify the benefits you get. Moreover, the nominal of this interest rate is higher when compared to other bank products so that the profits are greater.

The next characteristic of this certificate is the lack of risk that makes you more likely to receive profits than losses. The rate has indeed been set and has also been guaranteed by the bank. So there will be no risk that your deposits will decrease or may fluctuate. In addition, your deposit will also get protection precisely from the Deposit Guarantee Agency.

See Also List of Swift Codes Bank in Indonesia

Swift Code Bank BCA

Swift Code Bank Mandiri

Swift Code Bank BNI

Swift Code Bank BRI

Swift Code Bank Danamon

Swift Code DBS Bank

Swift Code Hana Bank

The last characteristic of a certificate of deposit is its advantages that can be used as loan guarantees. This certificate can indeed be used as a debt guarantee and can even be traded. Because the certificate is not listed the name of the holder so the ownership is very easy to transfer.

How Certificate Deposit Works

Those of you who are bank customers can certainly distinguish certificates of deposit with products from other banks. Certificates of deposit have a fairly different way of working with other investment products. Usually, deposits tend to have higher interest each year when compared to interest from ordinary savings.

As previously it has been explained that the process of withdrawing money must be done following the predetermined date. This is what makes deposits a very different investment product and is considered profitable for most bank customers. The investment process in this way is considered to provide more tangible results because of the long storage of funds and the withdrawal process that cannot be done at any time.

Steps to Open a Certificate Deposit

To open a Certificate Deposit, several things must be considered. The first thing to note in this case is the presence of cash with a certain amount. This cash is at least enough to be stored to carry out activities in the future.

Not only cash that needs to be owned but also there is a commitment in yourself not to use the money that has been invested in this form of deposits at any time. Do not let you withdraw the money that has been invested before maturity. If indeed you can do it then you can immediately open a deposit.

What is a CD in banking or Certificate Deposit is no longer a form of foreign product. Even more so in this day and age which is full of various kinds of investments. Certificate Deposit itself can provide great benefits for customers or bank customers.

Download Transfez App

Transfez App can help you transfer money abroad more quickly and efficiently. Transfez Business can also help your business in making transactions abroad. For those of you who want to send money to relatives who are abroad because they are studying, working, or traveling, Transfez will be ready to help. This app is available on Android as well as iOS.

Moreover, interest rates tend to be high and quite competitive. Of course, this makes customers feel happy, especially with the benefits obtained. No wonder this Certificate Deposit is quite much in demand by bank customers. Even this product is increasingly being used by many bank customers.