International money transfers can now be done through banks, one of the most familiar options for sending money abroad. However, this convenience wasn’t always the case, especially considering that every country has different legal regulations. About 150 years ago, the idea of cheap and secure international money transfers was still just a dream.

So, when did money transfers actually begin?

The First Wire Transfer Service in the 19th Century. The history of money transfers began in 1872 with the invention of the telegraph network. Beyond just sending messages, an American communications company used this network to perform wire transfers.

The sender would pay a certain amount at a telegraph office, and the operator would send a message to another office to release the funds. Passwords and book codes were used to authorize the release of money to a recipient in another country. That communications company eventually evolved into one of today’s leading international money transfer providers.

SWIFT Codes Make Transfers Safer

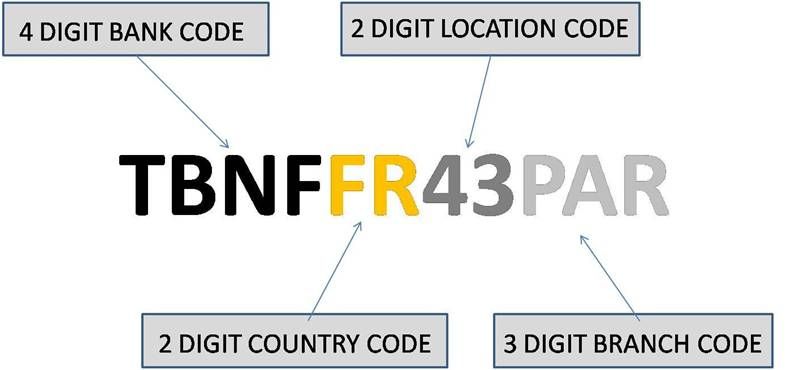

The SWIFT code, also known as the Bank Identifier Code (BIC), is an international bank code that identifies banks worldwide. This code, which consists of 8–11 characters, is commonly used for transferring money to foreign banks.

With SWIFT codes, transfers can be made faster through electronic processing. These codes also ensure security, as each transaction can be tracked using the unique identification number. As a result, transferring money between banks in different countries has become much easier.

See also Bank Swift Codes in Indonesia

Swift Code Bank BCA

Swift Code Bank Mandiri

Swift Code Bank BNI

Swift Code Bank BRI

Swift Code Bank Danamon

Swift Code DBS Bank

Swift Code Hana Bank

The Emergence of Online Money Transfer Services

With the rise of the internet, money transfer services began to change. In 1998, the launch of PayPal as a digital payment service opened the world’s eyes to the possibility of building a secure digital payment ecosystem, especially within the growing e-commerce industry.

By 2008, a massive global financial crisis shook the markets. As trust in big banks and financial institutions waned, particularly due to the lack of transparency in international transfers, online money transfer companies began to fill that gap.

The rise of the fintech industry further accelerated this trend. A modern, global lifestyle, moving abroad, studying overseas, and running multinational businesses with branches across countries, has made international money transfers part of everyday life. Now, finding the cheapest international transfer service is no longer impossible. Sending money abroad is as easy as sending it locally.

See Video on How to Easily Send Money Abroad with Transfez

Transfez: A Licensed and Reliable Solution for International Transfers

Transfez is one of the licensed remittance companies in Indonesia, authorized by Bank Indonesia, offering international money transfer services. To date, Transfez has facilitated tens of thousands of transfers, with a total value exceeding IDR 200 billion.

Here are three key benefits of using Transfez:

- You can transfer money abroad entirely online via the app. No more waiting in long bank queues or days for funds to reach the recipient.

- Save up to 91% on fees thanks to affordable transfer costs and competitive exchange rates. What you see is what you pay, no hidden charges.

- Transfez’s support team is available whenever you need assistance, making the process as smooth and reliable as waiting for money to arrive in the recipient’s bank account.

So, now you know which international transfer service is the cheapest!

Choose and download Transfez today!

Download Transfez App

Transfez App can help you transfer money abroad more quickly and efficiently. Jack Finance can also help your business in making transactions abroad. For those of you who want to send money to relatives who are abroad because they are studying, working, or traveling, Transfez will be ready to help. This app is available on Android as well as iOS.