To keep your account secure and enable full transactions, you’ll need to complete identity verification (KYC) in the Transfez Singapore app.

Follow the steps below to finish your verification smoothly.

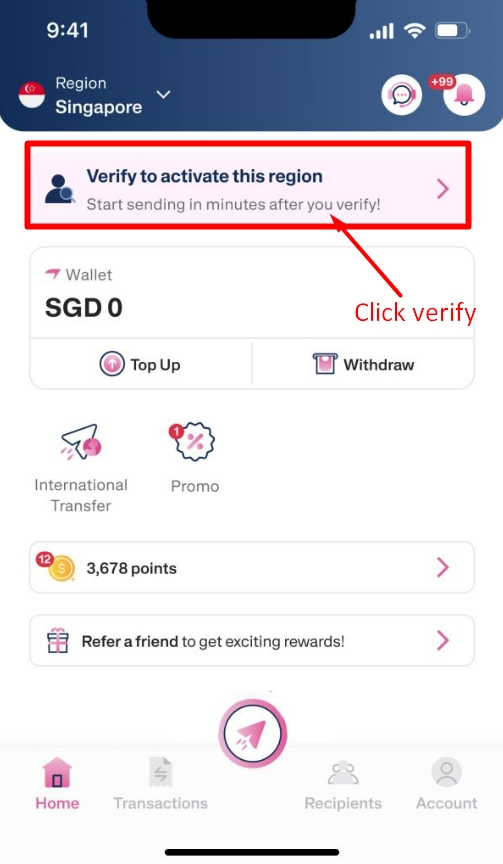

1. Start Verification from the Home Screen

From the home screen:

-

Tap Verify to begin your identity verification.

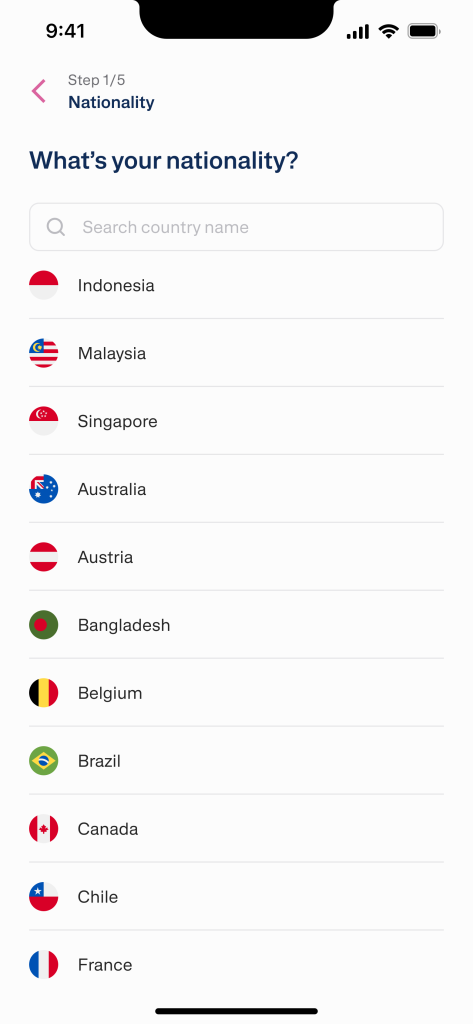

2. Select Your Country of Origin

Next, choose your country of origin. (If you are an Indonesian citizen working in Singapore, please select Indonesia).

This helps the app match the right verification flow and required documents.

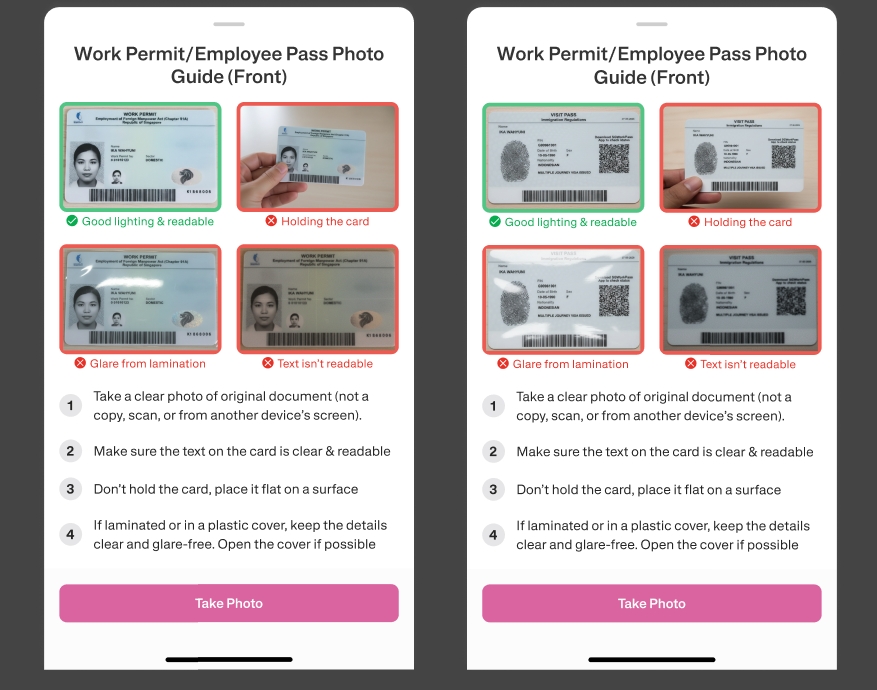

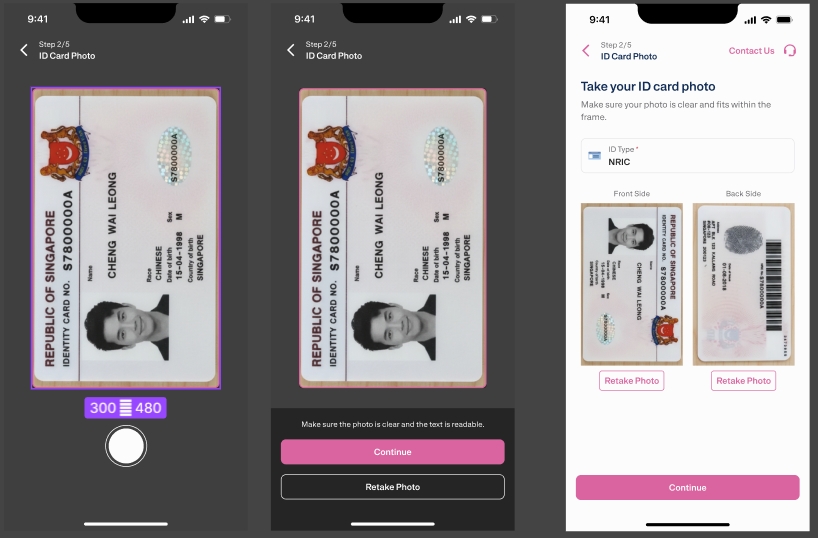

3. Prepare Your Document (Work Permit / NRIC)

Get one of the following documents ready:

- Work Permit (if you are an Indonesian citizen), or

- NRIC (if you are a Singapore citizen).

Then take a clear photo of your document directly in the app.

Tips for best results:

- Place the document on a flat surface

- Use good lighting

- Avoid glare and shadows

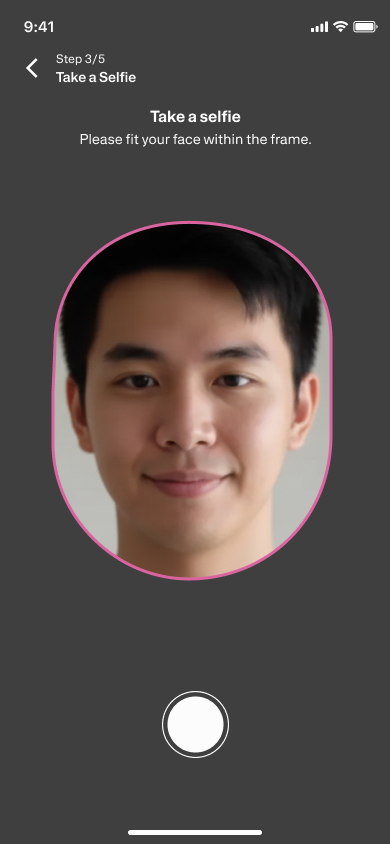

4. Take a Selfie / Live Photo

Next, you’ll be asked to take a selfie (or a live photo) to verify your face.

For best accuracy:

- Face a light source (e.g., near a window)

- Remove your mask or glasses

- Make sure your face is clearly visible in the frame

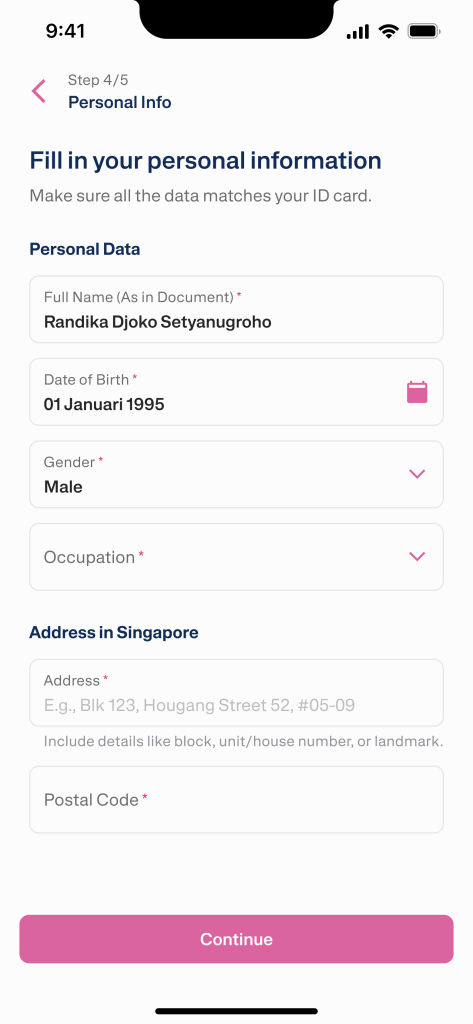

5. Fill in Your Personal Details

After completing the document and selfie steps, enter your personal details such as:

- Full name

- Residential address

- Other required information is shown in the app

Make sure everything matches your documents to avoid delays.

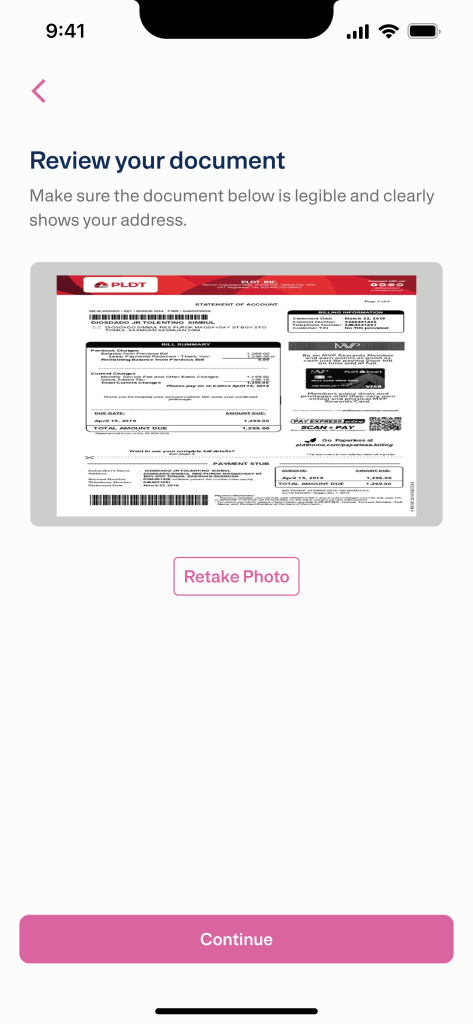

6. (Optional) Upload Additional Documents to Increase Limits

Don’t need to upgrade/increase your limit yet? Don’t worry, these additional documents are only required when you want to increase your sending limit, and you can upload them at any time if needed.

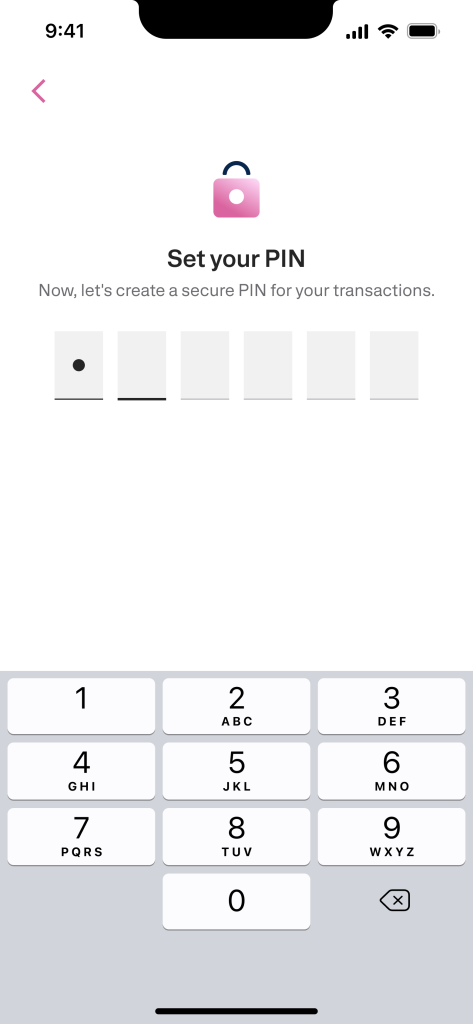

7. Set Up Your Transaction PIN

Create a transaction PIN for important actions in the app.

Choose a PIN that:

- You can remember easily

- Others can’t guess easily

You’ll usually be asked to confirm it once more.

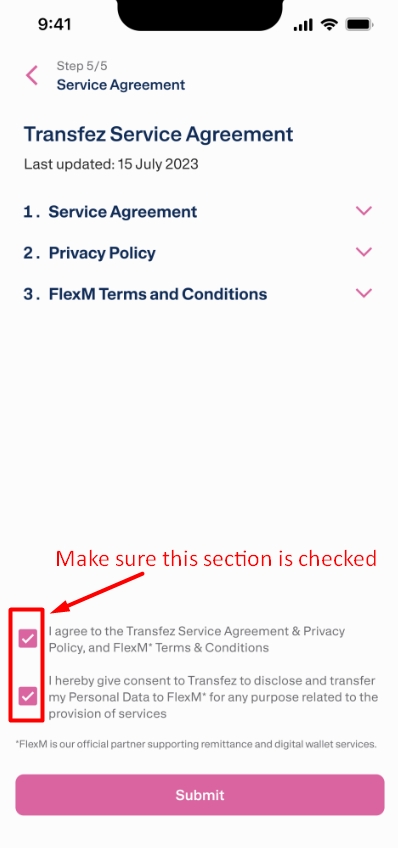

8. Accept the Service Agreement

Before submitting:

- Review the Service Agreement

- Tick the checkbox once you’ve read it

- Tap I Agree to proceed

9. Wait for Verification Review

Done ✅

Now, simply wait for the Transfez team to review your submission. You can track the verification status in the app (the KYC process takes approximately 5-10 minutes, so please monitor notifications or double-check your verification status.).

The verification process on weekdays typically takes a few minutes. Applications submitted on weekends will be processed the next business day.

10. Verified = Fully Active Account

Once approved, your Transfez account will be fully active and ready to use—including sending money from Singapore to Indonesia.

If you still have questions, please contact our Customer Service via our Email at [email protected] or via WhatsApp at +65 - 9244 - 8077