Whenever someone performs any financial transaction in a bank, there must be two important things written by the person. It is the routing number and account number, which shall be informed to help identify the customers. However, this number is usually ignored and does not get specific attention from most customers. While it is one of an important number to consider.

In most cases is that many customers don’t realize the number. This is due to the lack of information provided by the bank officer to the customer. Therefore, to help give a good understanding of both, routing number and account number, the following paragraphs will help to give a clear brief.

Overview of Routing Number

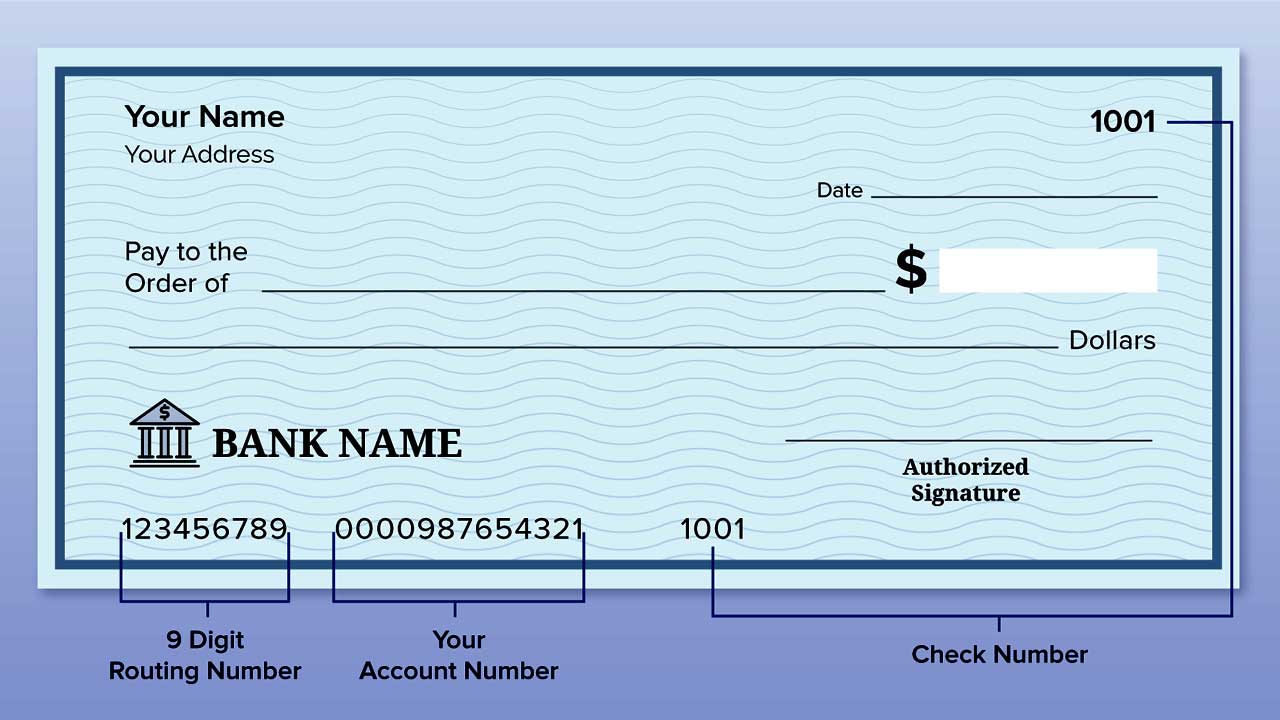

The first is to have a clear overview of the routing number. A routing number is a number that identifies the financial institution whenever any financial transaction is performed. This number is consisting of nine digits the number and refers to a proven account with Federal Reserve. This is a common necessary number that shall be provided during the financial transaction in the USA and Canada.

The routing number will help to inform the status of the institution. Whether the bank is a federal institution, or it is a state-chartered institution. In other meaning, this routing number can help to track the background of the bank institution whenever a financial transaction is performed under their institution. So that it can help to manage a valid transaction.

Send Money Easily to Different Countries

How to Send Money to Hong kong

How to Send Money to Philippines

How to Send Money to Australia

How to Send Money to Turkey

CHow to Send Money to United Kingdom

How to Send Money to Germany

How to Send Money to Netherland

How to Send Money to France

How to Send Money to Spain

How to Send Money to United States

How to Send Money to Singapore

How to Send Money to China

How to Send Money to Malaysia

How to Send Money to Japan

In case that you were never informed about this number, then you can specifically check your transaction note in the bank. A small bank will have one routing number, but a greater multinational bank may have more than one routing number. This number may be depending on the state or bank location in the country.

Overview of Account Number

A next important number is an account number. This is a quite common number to remember and recognize by the customer. Since any transaction will require the account number to define the personal account. To get the information of this account number, usually, it is written in the bankbook on the first page of the book.

An account number consisting of between eight to twelve numbers. This number can specifically determine the personal account, such as the name, address, and any private or confidential information of the customer. Therefore, it is necessary to make sure that your account number is kept private and will not share unless for any important matters.

The Difference of Routing Number and Account Number

Many customers might experience problems comparing routing numbers and account numbers. But, according to the above information, it shall be easy to define the difference now. If a routing number relates to the number of the bank institution, then the account number is the number of the personal account.

See Video How To Easily Send Money Overseas

Of course, both are relating to each other. Since a routing number will work in parallel with the account number. Any transaction notes shall mention both of the numbers to check the institution responsible for the transaction, and the personal account number will specify the account that held the transaction. However, if you feel you need to understand how to specifically define each of them, routing number and account number, the following tips can work to help you identify it.

• Check for the total number of the account digit. As mentioned previously a routing number will consist of nine digits, while an account number can consist of between eight to twelve digits.

• A routing number of a bank will always be the same number. Except that different branches might have a different routing number. But be note that the account number is specific and personal for each customer. Therefore, you will find that there will be no similar account number in any bank.

• A routing number is given by the Federal Reserve banks, while an account number is usually given from the bank institution. Therefore, it will create a different specific number for each. Through the information, it will ease the process to perform any financial transaction. Such as providing information on which bank institution help to perform the transaction and which person perform it.

• Routing number breakdown is normally consisting of the routing transit number, American Banker Association number, Fedwire numbers, and check routing number. While account number breakdown is normally consisting of the bank institution number and the unique number of the account holder.

According to the explanation above, it is now easier to conclude the difference between routing number and account number. If previously you have no overview about this number, then now you can understand how important to identify the number.

In case you don’t have any information about this routing number and account number, it is better to make sure with the banking institution. So that you can avoid any possibility of a failed transaction or wrong account number.

Download Transfez App

Transfez App can help you transfer money abroad more quickly and efficiently. Transfez Business can also help your business in making transactions abroad. For those of you who want to send money to relatives who are abroad because they are studying, working, or traveling, Transfez will be ready to help. This app is available on Android as well as iOS.