What is APY in banking will be interesting to understand. APY stands for Annual Percentage Yield, and it is following the needs of the financial institution concerned to be checked. APY or Annual Percentage Yield is often referred to as interest rates. So of course its existence is very important, especially for bank institutions that often provide loans to customers and bank customers.

Interest rates themselves are certainly familiar to anyone, especially for those of you who have made loans to the bank. APY or interest rate is certainly charged by the financial institution of the lender’s bank to the party receiving the loan from the bank.

While the large interest rate itself depends on the provisions of the relevant institution. The amount of interest charged to each borrower may also be different. To better get to know and understand what APY is and how to calculate it, then you can see the information and explanation below.

Understanding About APY

APY or Annual Percentage Yield which is also commonly called interest rate is may already be drawn in your mind as described earlier. APY is commonly used as an indicator that can be used to measure the amount of nominal amount obtained by a person and then calculated precisely for a year. So this resembles a method that can be used to measure how interest rates grow over time.

See Also Articles About How to Open Bank Accounts in Different Countries

How to Open a Bank Account in Australia

How to Open a Bank Account in India

How to Open a Bank Account in Japan

How to Open a Bank Account in Malaysia

Of course, APY which is part of this interest rate is charged to the borrower some funds used for the use of an asset. With this burden, the borrower must return the borrowed funds with an amount exceeding the funds received when conducting the loan process.

Implementation of APY

Each bank’s financial institution implements this APY following established and applicable procedures and conditions. APY which is more commonly called this interest rate generally applies to loan transactions by customers or bank customers.

Many factors underlie a person until deciding to apply for a loan from a bank. Whatever the reason, borrowers to the bank must be charged an interest rate following the provisions of the bank. So that this loan money will be paid back at once precisely on a predetermined date and has been agreed.

See Video How To Easily Send Money Abroad

The return of this loan is generally also done by way of periodic installments. In this case, the amount of money returned is more than the loan. So that the borrower can compensate for the loss of the use of money precisely during the loan period.

Steps to Calculating APY

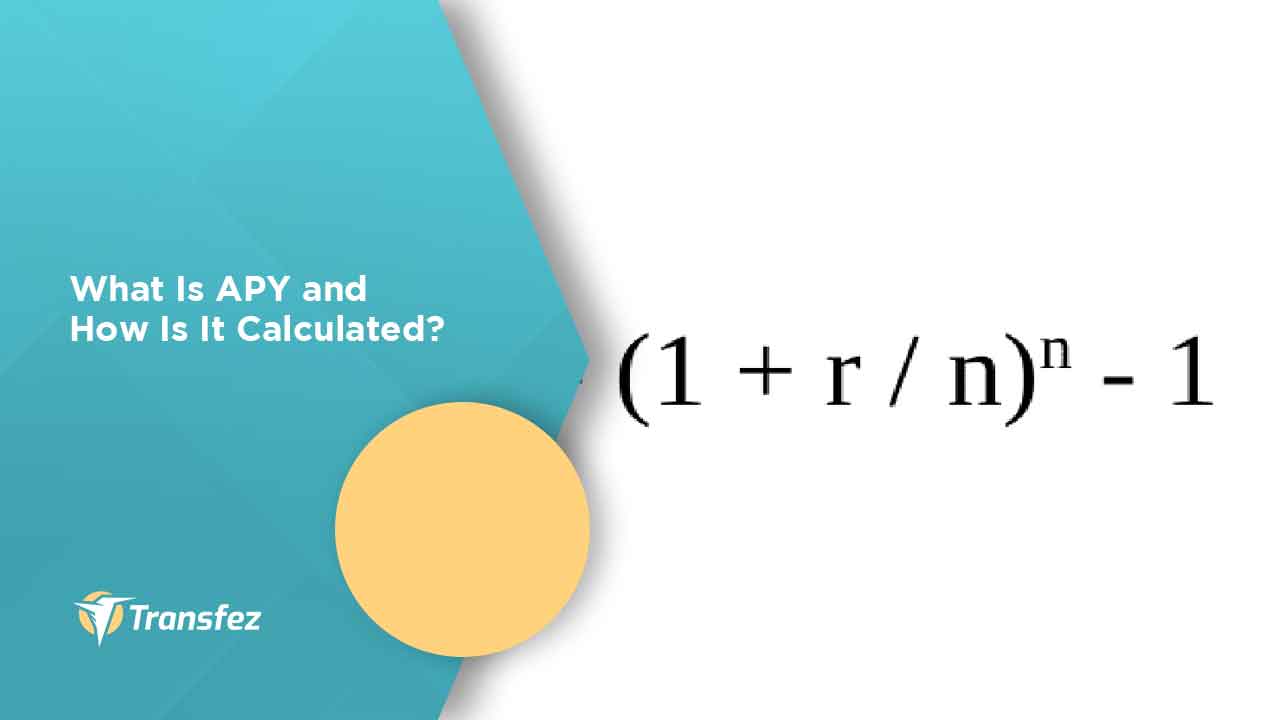

Calculation of APY must certainly be done appropriately so that later the prevailing and applied interest rates can be following the provisions. Those of you who are curious about how to calculate APY needs to understand its predetermined formula.

The formula used to calculate APY is APY=(1+r/n)^n-1 where r is the interest rate and n is the compound interest period. In APY the compound interest period is required for 12 months. It is a formula to calculate APY manually. The compound interest that is intended here refers to the interest accumulated precisely based on the predetermined period.

• Simple Interest Rates

Interest rates themselves generally consist of several types namely simple interest rates. From the name alone it can be described that the calculation of interest rates is also simple as the name implies. The formula to calculate simple interest rate is loan × rates × time. This method is also a manual way that allows you to do easier calculations.

See Also List of Swift Codes Bank in Indonesia

Swift Code Bank BCA

Swift Code Bank Mandiri

Swift Code Bank BNI

Swift Code Bank BRI

However, usually, the bank’s financial institutions have included the burden of this interest rate to customers or borrowers of funds. So you can immediately know how much funds should be returned to the bank for example at the time of consultation at the bank.

• Compound Interest Rates

In addition, there is also a type of compound interest rate that can also be calculated using a certain formula. The formula is as follows, compound interest rates = p× [(1 +interest rate)n−1] where p, in this case, is the principal while n is the number of doubling periods. These compound interest rates can also be referred to as interest on interest so that the borrower must repay the loan by paying more interest. This interest rate is also applied to the accumulated interest of the previous period.

What is APY (Annual Percentage Yield) in banking which has the same meaning as interest rates is certainly a familiar thing for bank customers. Its application is certainly done by almost all financial institutions in the bank that generally provide loan services to customers.

With this APY, every customer or bank customer who gets a loan from the relevant financial institution will make a return in a higher amount. Given how important APY is, every one of you should be able to understand more about this. The interest rate in each financial institution can generally be found in almost all banks. The system in every bank is almost the same.

Download Transfez App

Transfez App can help you transfer money abroad more quickly and efficiently. Transfez Business can also help your business in making transactions abroad. For those of you who want to send money to relatives who are abroad because they are studying, working, or traveling, Transfez will be ready to help. This app is available on Android as well as iOS.

Therefore, the existence of this interest rate should be known correctly by all of you so that the application of this interest rate can be understood appropriately by the public. Until finally the utilization of services from the bank can function optimally with the presence of this APY.