Running a business but still unsure about the difference between a receipt, invoice, payment receipt (kwitansi), and sales note (nota)? These documents are often used interchangeably, but they actually serve very different purposes. Misunderstanding their functions could lead to administrative errors and poorly recorded transactions.

This guide will help you understand the distinctions between a receipt, invoice, kwitansi, and nota from their definitions to when and how to use each one. It’s a practical reference for MSMEs, accountants, finance teams, and business professionals looking to streamline financial documentation.

Understanding the Definitions and Functions

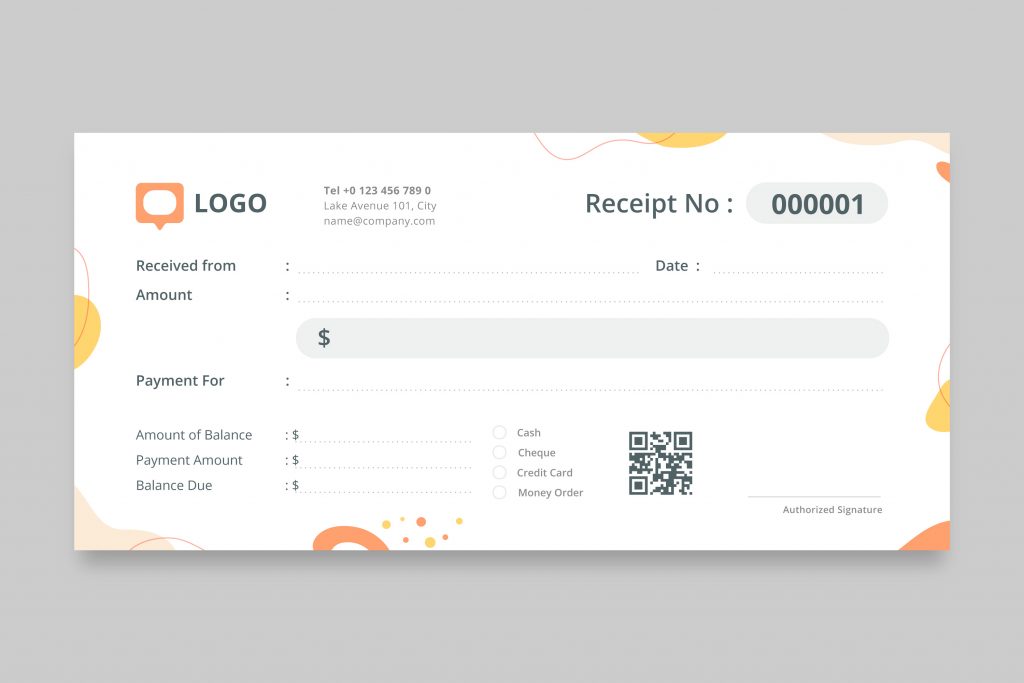

1. Receipt

A receipt is a proof of payment issued at the point of sale, typically printed by a cash register. It shows transaction details such as items purchased, quantities, prices, total amount, and payment method. Receipts are mainly used in retail or immediate payment scenarios.

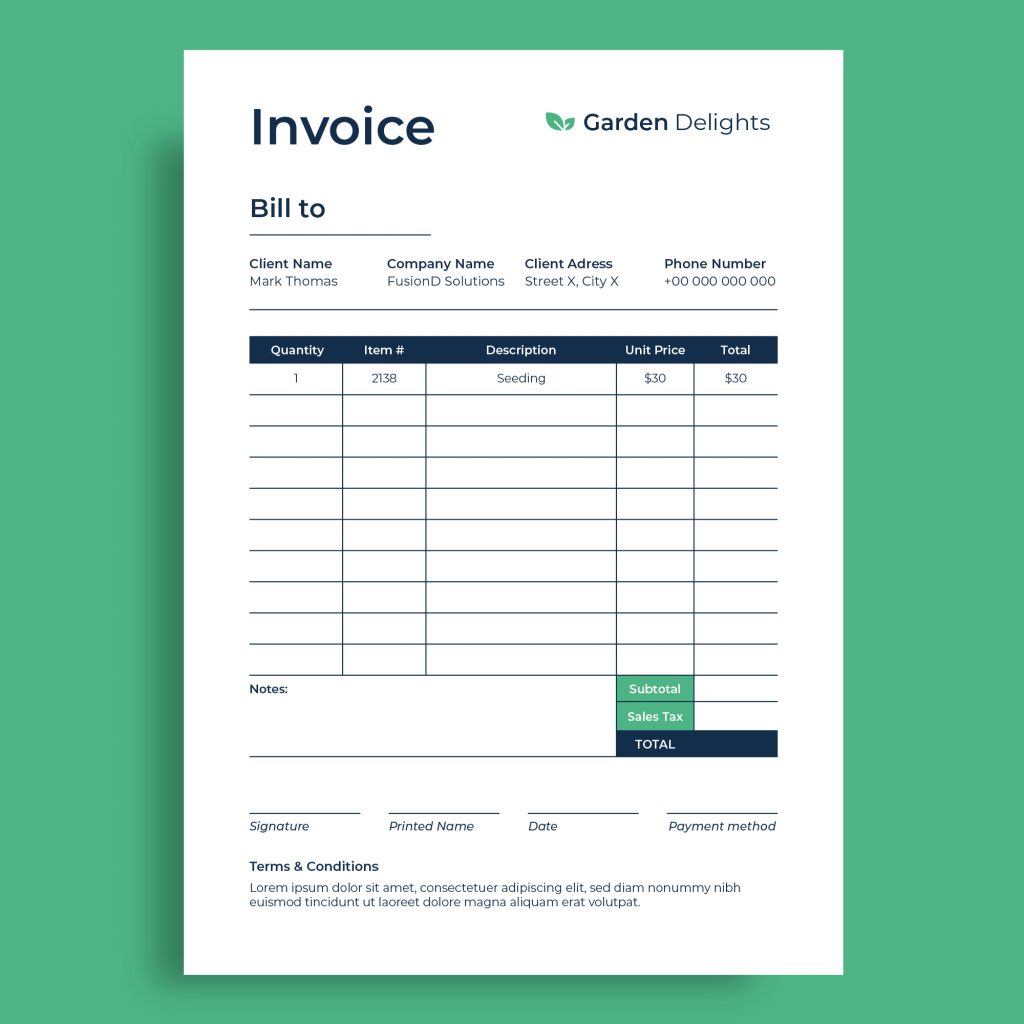

2. Invoice

An invoice is a formal billing document sent by a seller to a buyer for goods or services delivered but not yet paid. Common in B2B transactions, it includes comprehensive details like company names, itemized charges, applicable taxes, and payment terms.

3. Payment Receipt (Kwitansi)

A kwitansi serves as confirmation that a payment has been made. It is usually signed by the recipient and given to the payer. Widely used in manual transactions—like rent, project settlements, or personal payments—this document holds legal value as proof of payment.

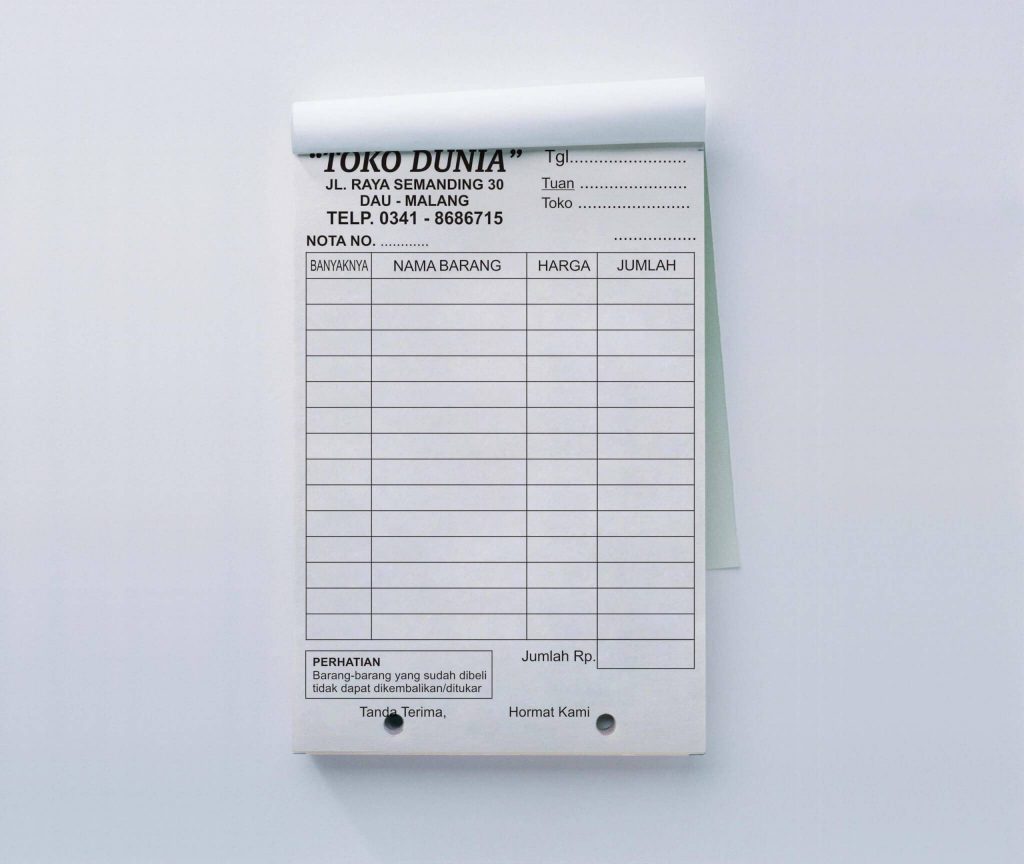

4. Sales Note (Nota)

A nota is used to record cash transactions, similar to a receipt, but can be handwritten or manually created. It confirms that a good or service was delivered and paid for in full at the time of sale.

Read Also: Pay Vendors Using a Credit Card? Here’s How It Works and Why It’s More Efficient

Key Differences Between Receipt, Invoice, Payment Receipt, and Sales Note

| Aspect | Receipt (Struk) | Invoice | Payment Receipt (Kwitansi) | Sales Note (Nota) |

| Issued When | After payment is completed | Before payment is made | After payment is completed | Before or upon payment |

| Purpose | Proof of retail purchase | To request payment for goods or services | Legal proof that payment has been received | Record of cash purchase |

| Format | Automatically generated by POS or cashier system | Formal document, often digital or PDF | Typically handwritten or printed manually | Manually written or printed in duplicate |

| Commonly Used By | Retailers, restaurants, supermarkets | B2B companies, vendors, and service providers | Contractors, individuals, informal transactions | Small businesses, microenterprises, local shops |

| Tax Included | Sometimes includes tax | Usually includes tax (e.g., VAT) | Does not include tax | May or may not include tax depending on the business |

Payment Receipt vs Sales Note

While both are used in purchase transactions, their purposes differ. A payment receipt (kwitansi) confirms that money has been received, containing details like the amount (in words and numbers), names of the payer and recipient, transaction date, and recipient’s signature. It serves as legal proof of settlement.

In contrast, a sales note (nota) outlines the items or services purchased, quantities, unit prices, and total costs. Its primary function is to document the transaction rather than verify payment. In short, the kwitansi confirms payment has been made, while the nota describes what was purchased.

How to Create Each Document

Creating an Invoice

Include the following:

- Seller & buyer names and addresses

- Invoice number and date

- Itemized list of products/services

- Pricing and taxes

- Payment terms and deadline

- Payment method

For faster processing, use digital tools like Jack Invoice or Transfez apps to generate and send invoices directly to clients.

Creating a Payment Receipt (Kwitansi)

Include:

- Receipt number

- Payment date

- Amount received

- Payer and recipient names

- Payment purpose

- Recipient’s signature

- Stamp duty if applicable

You can write it manually or use printable templates for a professional look.

Creating a Sales Note (Nota)

Include:

- Seller/store name

- Transaction date

- List of items and quantities

- Unit and total prices

- Seller’s signature

Usually made in two copies—one for the customer and one for business records.

Creating a Receipt

Typically auto-generated by a POS system. If done manually:

- Use a template with date, items, quantity, price, and total

- Add store logo and address

- Mention payment method (cash, card, etc.)

Small businesses can use simple POS apps or Excel templates.

Why It Matters

Understanding the differences between these documents helps keep your financial records clean and accountable. Using the right document for the right situation ensures that every transaction is properly logged and verifiable.

For businesses that want to automate invoicing and payments, consider using digital tools like Transfez’s Pay by Card feature. It reduces manual errors, saves time, and keeps all data safely recorded.

Read also: Credit Card Payment App for Local Vendor Invoices: Why Businesses in Indonesia Should Try Transfez

What is Pay by Card?

Pay by Card is a smart solution from Transfez that allows businesses to pay international invoices using a credit card—even when the vendor doesn’t accept card payments. This helps optimise cash flow while earning card benefits such as reward points, cashback, or air miles.

Transfez will convert your card payment into a bank transfer to the recipient abroad, enabling seamless cross-border payments even to traditional bank accounts.

How to Use Pay by Card

- Enter Invoice Details – Select destination country and payment amount.

- Upload Invoice & Recipient Info – Make sure all recipient account info is accurate.

- Pay with Your Credit Card – Supports VISA, MasterCard, and JCB.

- Transaction Processed – Transfez sends the funds directly to the recipient, with real-time tracking available.

Still using old-fashioned bank transfers? Switch to Pay by Card today!

✔ Keep your business cash flow flexible

✔ Earn card rewards while paying invoices

✔ Handle international payments with ease

📌 Click here to get started with Pay by Card

About Transfez

Transfez helps individuals and businesses transfer money abroad faster and more efficiently. Whether you’re sending money to family for school, work, or travel abroad, or managing corporate payments, Transfez is your trusted cross-border solution available on Android and iOS.