Have you ever heard of a SWIFT code when using international money transfer services? Yes, SWIFT is an acronym often mentioned in financial transactions. It stands for Society for Worldwide Interbank Financial Telecommunication. This organization was established in Brussels in 1973 with the goal of setting global standards for financial transactions.

One of its key functions is to support international money transfers. To perform such transactions, you need a SWIFT code so that the bank or transfer service can send funds to the correct recipient.

Still a bit confused? Let’s explore 4 essential things about SWIFT codes.

What is a SWIFT Code?

A SWIFT code is also known as a BIC (Bank Identifier Code), SWIFT BIC, or SWIFT ID. It consists of 8 to 11 characters that identify a specific bank during an international transaction. The purpose is to ensure the money reaches the right bank and the correct recipient.

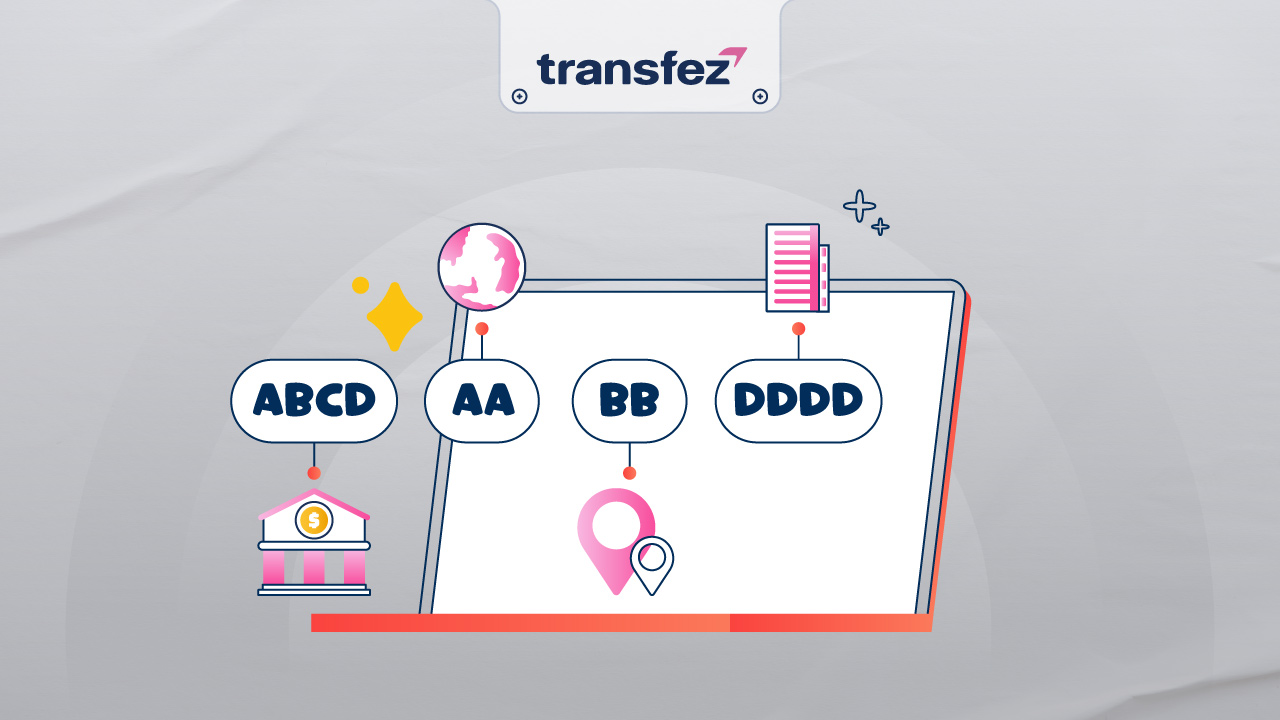

What Does a SWIFT Code Look Like?

When making an international money transfer, you’ll likely encounter a code like this: AAAABBCCDDD. Each section of the code represents the following:

- AAAA: 4-character bank code

- BB: 2-character country code

- CC: 2-character location code

- DDD: 3-character branch code (optional)

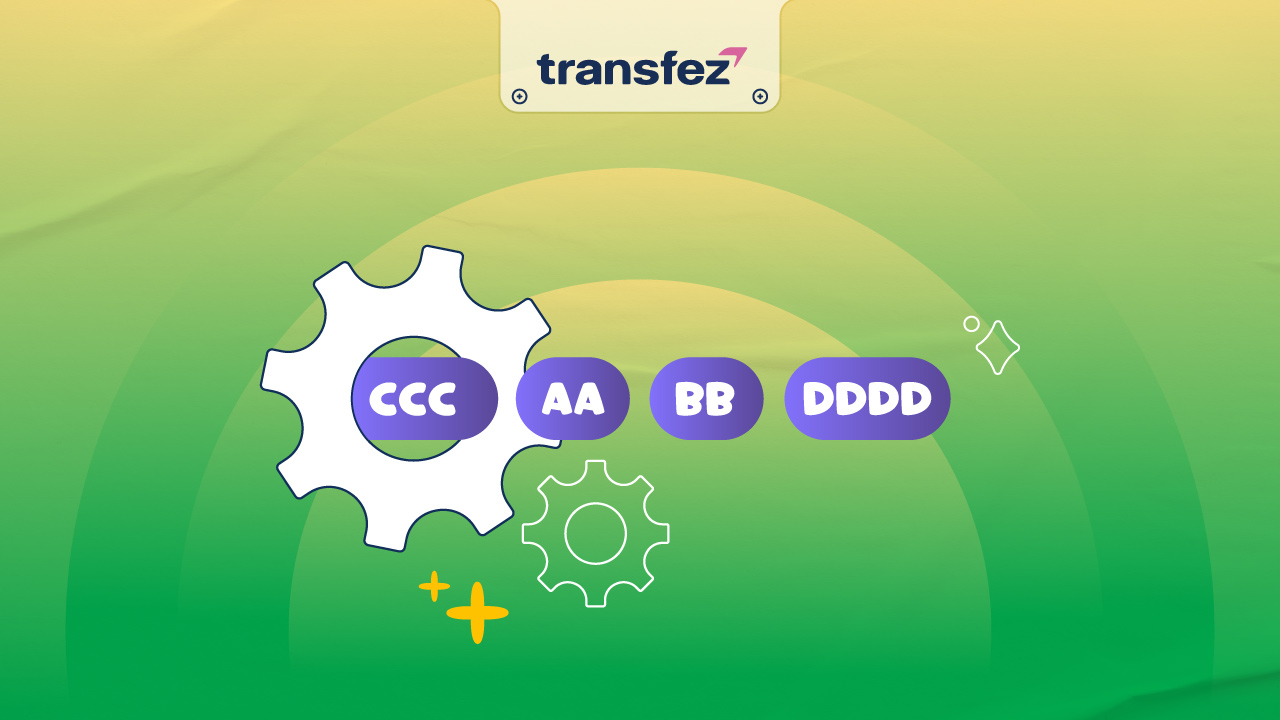

What Does a SWIFT Code Do for You?

As long as your bank is affiliated with the SWIFT network, you can be confident that your funds will be transferred securely and will reach the intended recipient. However, here are some things to keep in mind:

- Pay attention to the fees charged by correspondent and recipient banks.

- If the transfer involves currency exchange, banks often apply lower exchange rates and take a margin from the difference.

- SWIFT transfers can take up to 5 business days to process.

SWIFT Transfers Can Be Costly

Sending money via SWIFT can be expensive, especially if you’re only sending a small amount. Additional fees from intermediary banks or poor exchange rates can make the total cost much higher, without offering you or the recipient any extra value.

While SWIFT is one method to send money internationally, there is a better option that’s more affordable and beneficial for both sender and recipient: Transfez.

Transfez: A More Affordable Way to Send Money Abroad

Transfez offers a trusted international money transfer service that helps you save up to 91% on transfer fees. Simply download the app and register for free. Then, follow the easy steps: choose the amount you want to send, verify your identity, enter the recipient’s details, and pay the transfer fee to Transfez’s local bank account.

What’s even better? You can do everything straight from your smartphone, no need to go to a bank or wait in line. With Transfez, you stay productive, save time and effort, and send money overseas with ease.

After that, just sit back and wait for a “thank you” message from the recipient. And if you ever run into an issue, Transfez’s customer service team is ready to help anytime.

So now you’ve found the easiest and most convenient way to send money internationally. Download the Transfez app on your smartphone today!

Download Transfez App

Transfez App can help you transfer money abroad more quickly and efficiently. Jack Finance can also help your business in making transactions abroad. For those of you who want to send money to relatives who are abroad because they are studying, working, or traveling, Transfez will be ready to help. This app is available on Android as well as iOS.