What is a bank swift code is quite often known and met especially when making money transfer as the form of the financial transaction. The presence of this bank swift code can be the evidence of the progress and sophistication of technology applied also in the world of banking economics.

The development of technology that is increasing over time seems to have a positive impact on the banking world. Moreover, this is in terms of improving the quality of the bank’s financial institution services to all its customers. One of them that is visible is including the emergence of a bank swift code that will make it easier for every bank customer to carry out the activity of moving or transferring some money to the intended party.

Of course, every bank financial institution has a specific swift code that makes it easier for customers to make the transfer process. You could say that each of these codes is important. Therefore, it shall be a concern for bank customers who will indeed carry out the process of financial transactions from one bank to another. For a better understanding of what is a bank swift code and how it works, you can continue to see the explanation below.

Understanding About Bank Swift Code

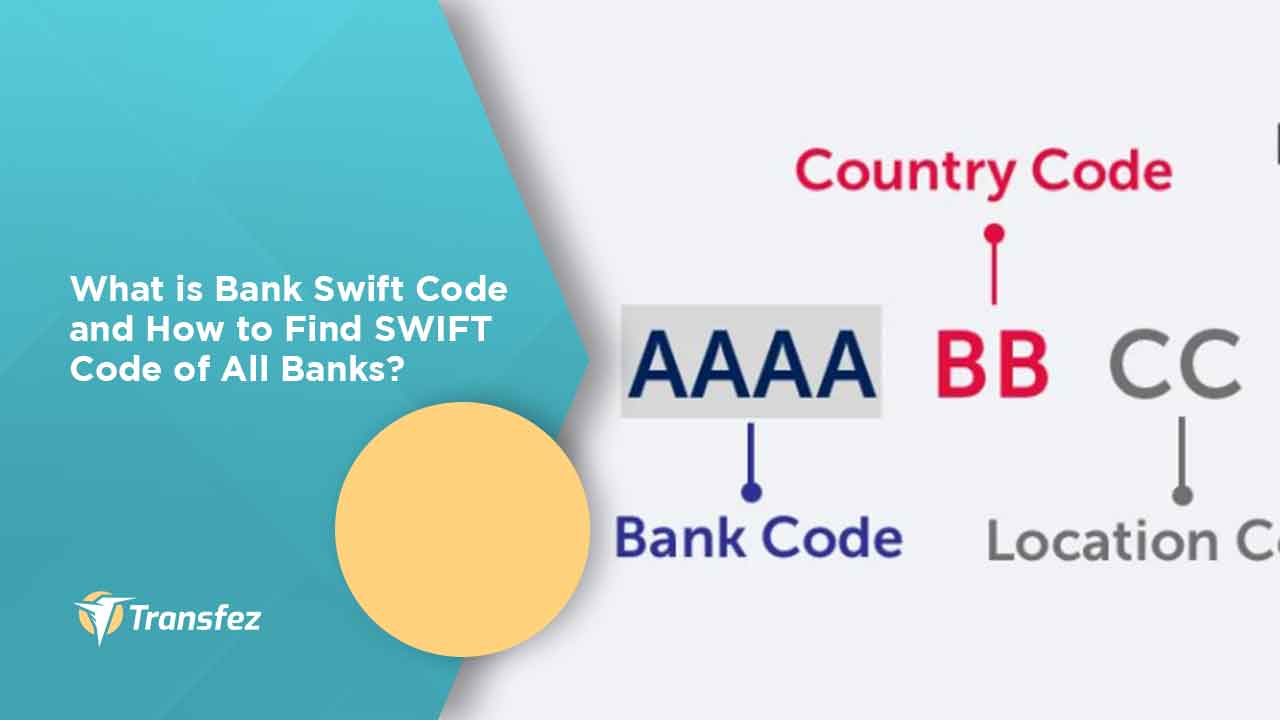

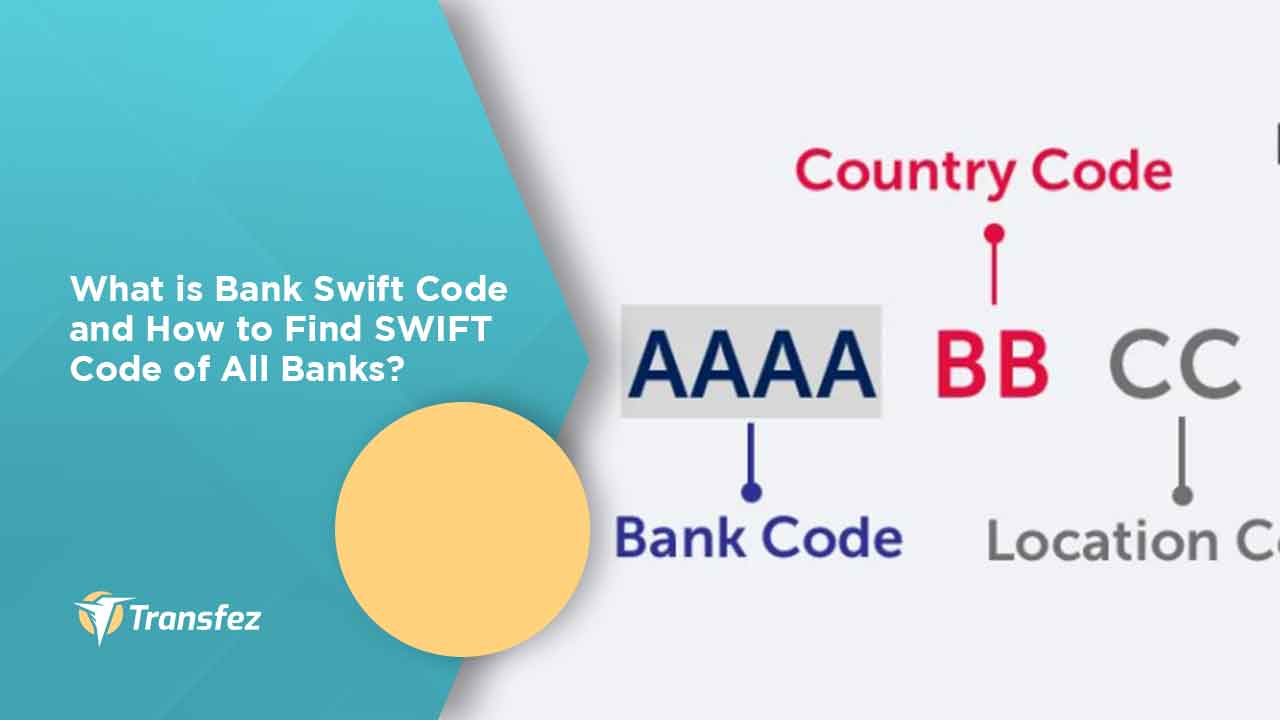

If you are a bank customer, of course, you have often seen the code of each bank. This code can be used as a bank swift code that will later make it easier for you to make the remittance process. A bank swift code is a unique code that generally consists of several letters. This code is required to assist customers of the bank in making transactions, especially money transfer activities.

See Also List of Swift Codes Bank in Indonesia

Swift Code Bank BCA

Swift Code Bank Mandiri

Swift Code Bank BNI

Swift Code Bank BRI

That is why the presence of this swift code is necessary to help connect and provide various financial information that will be needed by bank customers in making various transactions. Of course, this exchange of information will take place safely so anyone should not hesitate and be afraid to use this code.

The Function of Bank Swift Code

Every feature presented by banking institutions certainly has a very important function, especially in maintaining the continuity of banking activities. Similarly, the presence of bank exchange codes also has its specific function. This code can be used to process financial transactions online or virtually.

Its main function is to deal with the process of transferring or sending money from one bank to another or from one region to another. Even this transfer process is not only limited to the national sphere but also the international sphere. The right code will make the transfer process can run smoothly without any obstacles.

Characteristics of Bank Swift Code

Some people may have quite memorized the code owned by each bank. Especially if the person has a frequency that is quite often in the remittance process. For those of you who want to know more about the code of each bank, then you have to see it when you run the transfer process.

The domestic bank codes generally consist of three-digit numbers only. While some other bank codes may even easily enter your memory especially if you often make the process of sending money to the bank.

See Also Articles About How to Open Bank Accounts in Different Countries

How to Open a Bank Account in Australia

How to Open a Bank Account in Hong Kong

How to Open a Bank Account in China

How to Open a Bank Account in India

How to Open a Bank Account in Malaysia

However, some banks may have different codes to facilitate the process of financial transactions in an international scope. In this case, the bank swift code can consist of eight to eleven alphanumeric characters which can be said to be unique. Furthermore, to notice that this length is indeed following international standards.

The Benefit of Bank Swift Code

The existence of bank swift codes certainly has its advantages, especially in the banking world. One of the advantages is to show the characteristics and identity of a bank. Even this bank code can be remembered by every bank customer so this code is identical to a particular bank.

A number of these codes can also help the process of identifying banks more easily and quickly. Therefore, no wonder if then the transferor remittance process can run with a more practical system and can be done by every bank customer directly.

See Video How To Easily Send Money Abroad

Not only fast and practical but this existing code can better guarantee the financial transaction process that takes place smoothly and safely. All the characteristics and functions possessed by the bank code make it more useful for a financial transaction.

The existence of a bank code can be the right solution for financial transactions themselves. The process of transferring or sending money becomes safer and can run without any obstacles or obstacles. Of course, the presence of this bank exchange code is a very appropriate solution for the banking transaction process.

What is a bank swift code is certainly now become familiar to you all. With this code, every bank customer can make the transfer process easier. Financial transactions can be done more precisely because of the code that helps every bank customer in doing things related to banking.

Download Transfez App

Transfez App can help you transfer money abroad more quickly and efficiently. Transfez Business can also help your business in making transactions abroad. For those of you who want to send money to relatives who are abroad because they are studying, working, or traveling, Transfez will be ready to help. This app is available on Android as well as iOS.

Now the process of exchanging information in the banking world is certainly no longer complicated. Because the bank swift code has appeared and can be accessed by every bank customer. All the bank customers will certainly experience a nice and easier process of remittances. So that it can cause the like of maximizing the utilization of this bank swift code.