A bank power of attorney letter is commonly needed as a reference for individuals who require representation for banking matters. This document serves as legal authorization for another person to handle banking transactions on your behalf.

A power of attorney letter functions as strong legal proof of delegated authority. Without this document, a bank will not allow someone else to represent you in handling your banking affairs.

Definition of a Power of Attorney Letter

In general, a power of attorney (POA) is a written document granting authority to another person to act legally on your behalf.

In the banking context, a bank power of attorney letter is used when:

- You cannot attend in person

- You need someone you trust to manage banking matters

- You want to legally authorize another person to act on your behalf

This letter is typically given to someone who is trustworthy and responsible.

Functions of a Bank Power of Attorney Letter

In urgent situations, a power of attorney plays a crucial role. By using this document, you can officially appoint someone to handle your banking needs.

Its functions include:

- Providing legal written proof that authority has been granted

- Allowing banks to process transactions requested by the authorized representative

- Protecting both parties from potential legal disputes

With a valid power of attorney, banks can confidently process transactions requested by the appointed representative.

Benefits of Using a Bank Power of Attorney

Before reviewing a sample format, it’s important to understand the benefits of a bank POA letter:

- Withdrawing funds through a trusted representative

- Opening a bank account on your behalf

- Conducting large bank transfers

- Managing issues related to lost ATM cards or bankbooks

Bank Power of Attorney Format

When creating an official power of attorney letter, certain components must be included to ensure validity.

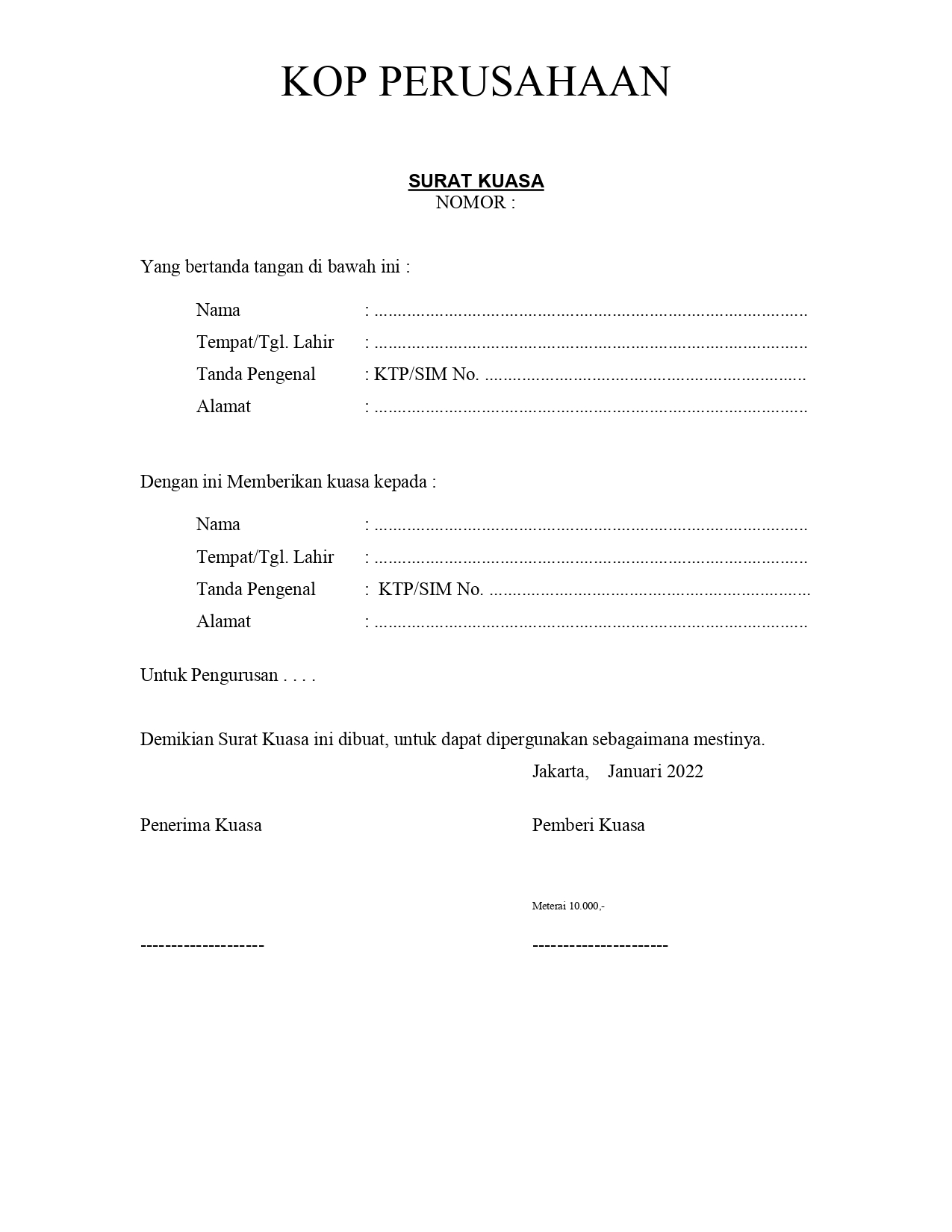

1. Letterhead (If Applicable)

If the letter is issued by:

- A company

- An organization

- An institution

It must include an official letterhead. For personal use, a letterhead is not required.

2. Letter Number (For Corporate Use)

If issued by a company or organization, the document should include a letter number.

For individual use, a letter number is not mandatory.

3. Identity of the Grantor and the Representative

The letter must include complete identification details of both parties, such as:

- Full name

- ID number (National ID / Passport)

- Date and place of birth

- Residential address

- Active phone number

Clear identification helps avoid future disputes.

4. Purpose of the Power of Attorney

The letter must clearly state the specific purpose of granting authority.

Examples include:

- Opening a bank account

- Withdrawing funds

- Printing bank statements

- Closing an account

- Other specific banking transactions

The purpose should be detailed and unambiguous.

5. Detailed Scope of Authority

Beyond stating the purpose, the letter should clearly define:

- The scope of authority granted

- Any limitations

- The validity period of the authorization

This prevents misuse of authority.

6. Stamp Duty and Signatures

At the end of the letter:

- Include the signatures of both parties

- Attach the required stamp duty (if applicable)

- Clearly state the date of issuance

This ensures the letter is legally valid.

Basic Sample Bank Power of Attorney (Template)

Below is a simple template you can adapt:

Requirements for Creating a Bank Power of Attorney

To ensure the document is legally valid, the following conditions must be met:

- Mutual agreement between both parties without coercion

- The matter must relate to banking purposes

- Both parties must be legally competent adults and mentally sound

- Clear identification of both parties

- Clearly stated validity date and duration

- Signed by both parties and affixed with a stamp duty (if required)

A bank power of attorney letter is an essential legal document when delegating banking authority to another person. Banks will accept this document as long as it meets their internal requirements and complies with legal standards.

Download the Transfez App Today

Transfez helps you send money abroad quickly, affordably, and securely. For businesses, Jack Finance simplifies international vendor payments. Whether you’re paying overseas staff, suppliers, or supporting a family member studying or working abroad Transfez is here to help. Available on Android and iOS.